What You Required to Know Prior To You File Your Online Tax Return in Australia

What You Required to Know Prior To You File Your Online Tax Return in Australia

Blog Article

Navigate Your Online Tax Obligation Return in Australia: Vital Resources and Tips

Browsing the on the internet tax return procedure in Australia requires a clear understanding of your commitments and the resources readily available to simplify the experience. Necessary documents, such as your Tax Obligation Documents Number and earnings declarations, need to be carefully prepared. Selecting an ideal online system can significantly impact the performance of your filing procedure.

Comprehending Tax Obligations

Individuals should report their income accurately, which includes earnings, rental income, and investment incomes, and pay tax obligations as necessary. Locals should comprehend the difference between taxed and non-taxable income to make certain conformity and optimize tax outcomes.

For companies, tax commitments include multiple aspects, consisting of the Goods and Services Tax (GST), company tax obligation, and payroll tax obligation. It is critical for services to sign up for an Australian Organization Number (ABN) and, if applicable, GST registration. These duties require meticulous record-keeping and prompt entries of income tax return.

Additionally, taxpayers ought to be acquainted with readily available deductions and offsets that can relieve their tax obligation concern. Inquiring from tax specialists can provide beneficial insights into enhancing tax settings while making certain conformity with the regulation. Generally, an extensive understanding of tax obligation responsibilities is crucial for effective monetary preparation and to avoid charges connected with non-compliance in Australia.

Important Papers to Prepare

In addition, compile any type of pertinent bank statements that reflect rate of interest revenue, along with reward declarations if you hold shares. If you have other sources of earnings, such as rental properties or freelance work, ensure you have documents of these earnings and any type of associated expenditures.

Do not forget to include deductions for which you may be qualified. This could entail receipts for occupational expenses, education costs, or charitable donations. Lastly, consider any exclusive medical insurance statements, as these can impact your tax obligation obligations. By collecting these vital files beforehand, you will simplify your on the internet tax return procedure, lessen mistakes, and make the most of possible reimbursements.

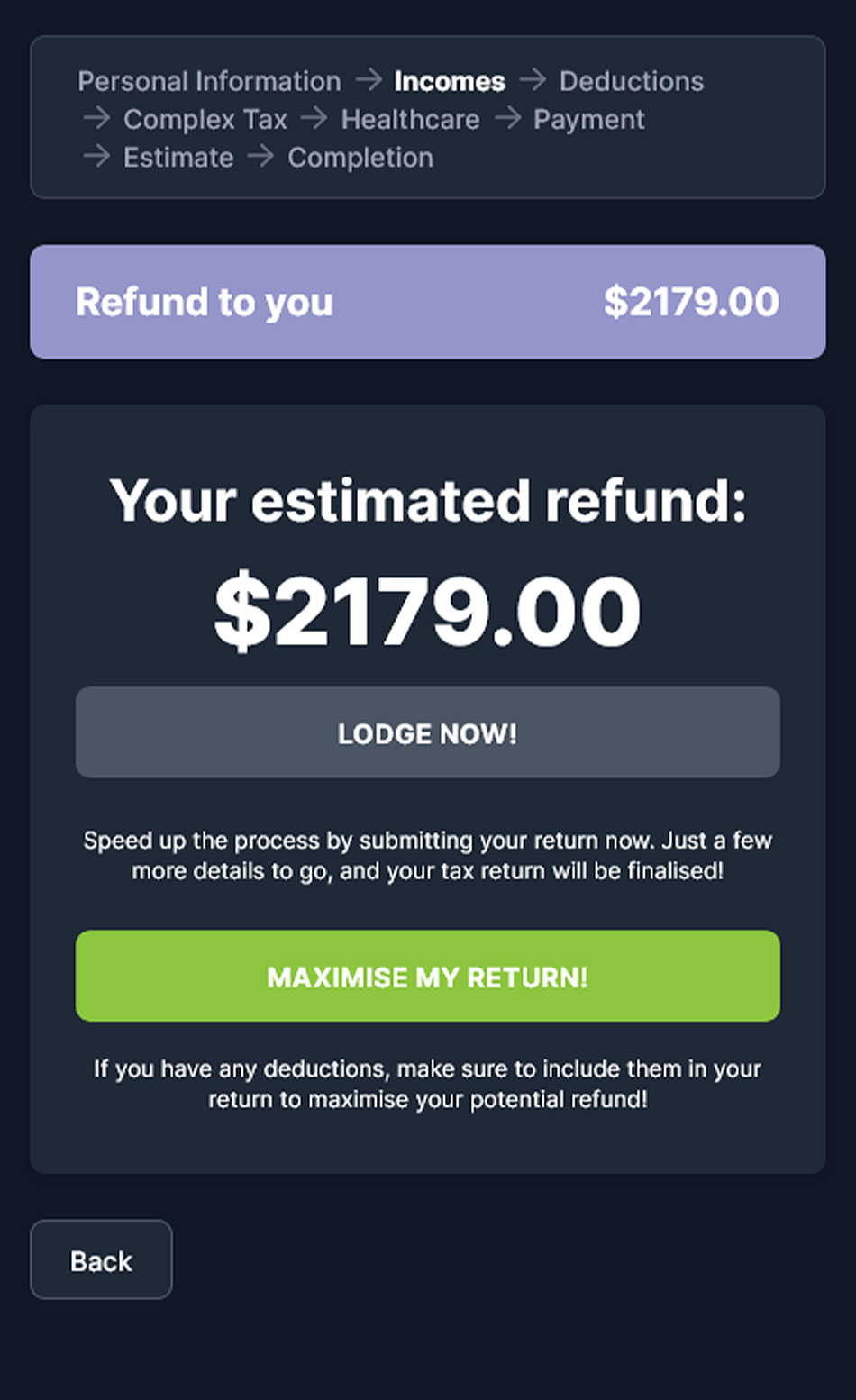

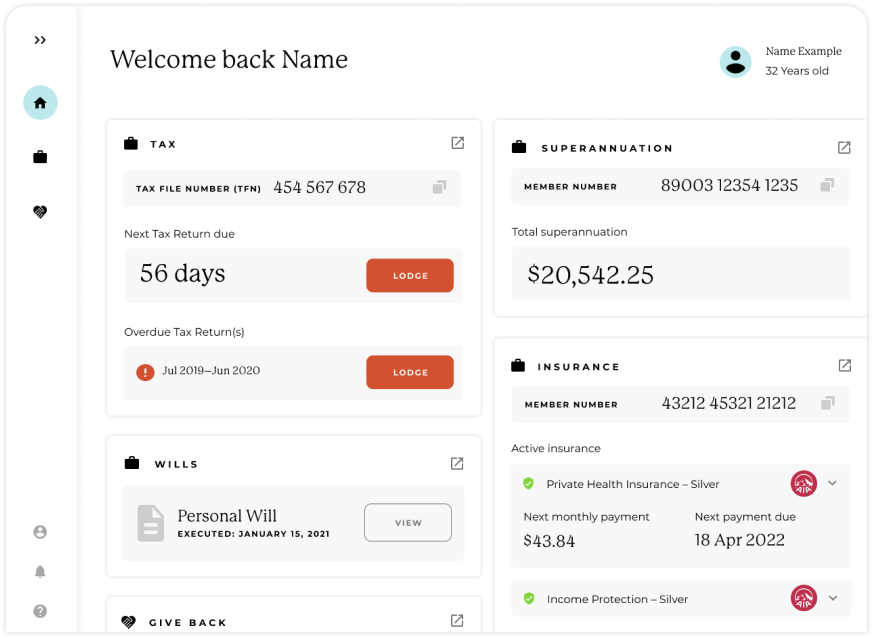

Picking the Right Online Platform

As you prepare to file your on-line income tax return in Australia, choosing the ideal platform is vital to guarantee accuracy and convenience of use. Numerous essential factors ought to guide your decision-making procedure. First, think about the platform's interface. An uncomplicated, intuitive style can dramatically enhance your experience, making it less complicated to navigate complicated tax return.

Next, assess the platform's compatibility with your monetary situation. Some services provide specifically to individuals with easy income tax return, while others supply detailed assistance for extra complicated circumstances, such as self-employment or financial investment income. Additionally, try to find platforms that use real-time mistake monitoring and guidance, aiding to minimize blunders and making sure conformity with Australian tax obligation legislations.

An additional essential facet to consider is visit this web-site the level of customer assistance offered. Reliable platforms need to supply accessibility to support using email, phone, or chat, particularly throughout height filing periods. Additionally, study user evaluations and ratings to evaluate the overall fulfillment and reliability of the system.

Tips for a Smooth Filing Refine

Filing your on the internet tax return can be a simple process if you comply with a few key suggestions to make certain performance and precision. This includes your earnings declarations, receipts for deductions, and any type of various other relevant paperwork.

Following, benefit from the pre-filling function provided by many on-line systems. This can save time and lower the opportunity of blunders by automatically populating your return with information from previous years and information provided by your company and financial establishments.

Furthermore, verify all access for precision. online tax return in Australia. Blunders can bring about postponed refunds or issues with the Australian Tax Workplace (ATO) Ensure that your personal details, income numbers, and deductions are correct

Declaring early not just decreases stress and anxiety but likewise permits for better preparation if you owe tax obligations. By following these pointers, you can browse the online tax return process smoothly and with confidence.

Resources for Help and Assistance

Browsing the intricacies of online income tax return can occasionally be daunting, but a variety of sources for aid and assistance are readily available to help taxpayers. The Australian Tax Office (ATO) is the primary source of info, providing thorough overviews on its site, including FAQs, educational video clips, and look at this website live chat choices for real-time support.

Additionally, the ATO's phone assistance line is readily available for those who favor direct interaction. online tax return in Australia. Tax obligation experts, such as licensed tax representatives, can likewise offer personalized advice and make certain conformity with current tax guidelines

Verdict

In conclusion, effectively browsing the online tax obligation return process in Australia calls for a comprehensive understanding of tax obligation responsibilities, thorough preparation of important files, and cautious option of an ideal online platform. Complying with functional pointers can boost the declaring experience, while available resources offer beneficial assistance. By coming close to the procedure with persistance and focus to detail, taxpayers can guarantee conformity and make best use of prospective advantages, inevitably adding to a much more effective and effective tax obligation return end result.

As you prepare to submit your on the internet tax return in Australia, selecting the appropriate platform is essential to guarantee accuracy and convenience of usage.In verdict, properly navigating the online tax return process in Australia calls for an extensive understanding of tax obligation commitments, meticulous prep work of important files, and mindful choice of a suitable online system.

Report this page